Archive

The True Cost of Dining Out

My husband and I are both foodies. We had grand plans to travel the world and eat at every 3 star Michelin restaurant. We did…until after eating at Le Bernardin in New York and running up a $527 tab (not to mention transportation costs to get to NY) when we realized we would go bankrupt if we kept this up.

My husband and I are both foodies. We had grand plans to travel the world and eat at every 3 star Michelin restaurant. We did…until after eating at Le Bernardin in New York and running up a $527 tab (not to mention transportation costs to get to NY) when we realized we would go bankrupt if we kept this up.

After tracking our expenses for about a year, I learned that we were spending approximately $600 a month on food. It wasn’t so much the price of the dinners as it was the frequency of them. On a bad month when we partook in fine dining, our dining expenses went as high as $1200. But on most months it hovered around $600. We were eating out 5-6 times a week. He was occasionally going out for lunch too.

What is the true cost of $600 a month spent on dining?

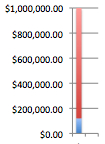

Say instead, you only spend $200 on dining and put the remaining $400 into a savings account with ING. That’s $4800 a year put into savings. Now even if the interest rates were to stay at it’s sad current rate right now for the next 30 years, this is what it would look like:

After 1 year:

Invested: $4800

Interest earned: $28.70

Total: $4828.70

After 5 years:

Invested: $24000

Interest earned: $783.32

Total: $24783.32

After 10 years:

Invested: $48,000

Interest earned: $3,230.12

Total: $51,230.12

After 30 years:

Invested: $144,000

Interest earned: $32,000.88

Total: $176,000.88

Now, putting it in a ING account with 1.3% interest is very conservative. Chances are, the interest rates will go up. Now say you put your money into a mutual fund and it generates about 6% of a return for you. By cutting down on dining out, not only are you trimming your waistline but you’re growing your nest egg. This is what 30 years with 6% will do for you.

Invested: $144,000

Interest earned: $257,806.02

Total: $401,806.02

The amount of interest you have earned is double the amount you have invested! This is what you are missing out on when you choose to eat out so often! True, eating out is fun…but is it worth almost half a million dollars to you?

How to Cut Down on the Cost of Eating Out

1) Learn to cook. Cooking can be therapeutic. It can be fun. It can be an activity that you do with your partner. If you think it’s too much work to cook for just 2 people, you are wrong. With just 30 minutes in the kitchen, you can make a mean lasagna that will feed the 2 of you for the next 2 days. Go and pick up a cookbook (or better yet – search for free recipes online) and pick something out for dinner tonight.

2) Don’t be a pig. At most restaurants, an entree alone will give you 1,000 calories. So is it really necessary to order an appetizer, side dishes and dessert too? Stick with just the entree and don’t even think about soda. Charging you $1.50 for a drink that is harmful to your health is not worth it. Water is free and it’s so much better for you!

3) Save the alcohol for special occasions. Alcohol is the biggest rip when it comes to the food and hospitality industry. I try to avoid alcohol unless we are out celebrating a special occasion. If you have an absolute craving, go pick up a bottle of $10 wine and have some before dinner!

4) Learn to love hole in the wall restaurants. Some of the best restaurants are those that shun the fine dining atmosphere. They are usually inexpensive, casual and have some of the best food in town. I love using Yelp to find these types of restaurants.

5) Go ethnic. Like hole in the wall restaurants, many authentic “international” restaurants offer tasty meals at a great price. In most cities, there is usually a Chinatown or International Boulevard where you can find good authentic eats for cheap. My personal favorites are Vietnamese pho, taquerias, noodle houses, ramen shops, dim sum restaurants, and all you can eat Indian buffets.

6) Invest in tupperware and brown bag your lunch. My husband likes a nice warm hearty meal for dinner. A typical warm hearty meal can usually feed about 4-6 people. So what do I do? Put the rest in containers and that’s lunch for the next day!

7) Use Restaurant.com. Go to Restaurant.com, type in your zip code and search for restaurants in your area that offer gift certificates that you can buy for just a fraction of the price (usually 20-30% of what it’s worth). I have bought $25 gift certificates for just $2! Be sure to read the fine print as some restaurants will require you to spend at least a certain amount or buy at least 2 entrees in order to use the gift certificates.

8) Buy cereal….or canned soup. I prefer not to eat a lot of processed foods but sometimes they come in handy if you are short on time or if you’re just plain tired and don’t have it in you to cook. Cereal, tuna fish, canned soup, ramen are all good alternatives if you just don’t feel like really cooking. I would lean more towards the tuna fish than the ramen for obvious reasons.

9) Go have lunch instead of dinner. If it’s the weekend and you’d like to have a meal out, opt for lunch. Lunch menus are usually cheaper than dinner menus. There’s also less of a crowd during lunch.

10) Check the menu before going out. Most restaurants will have their menus online so you can see what the prices are before you arrive at the restaurant. Pick your food before you get there and vow to stick with it and you’re less likely to make an emotional (and expensive) impulse decision once you’re at the restaurant.

Cutting down on your dining out expenses can be rough and requires a lot of discipline…especially when you are accustomed to the dining out lifestyle. But if I can manage to do it, anyone can. The hardest part is usually the first month. But once you get used to eating at home, it will seem like a special occasion to you when you go out to eat. Now, my husband and I will go out to eat about once a week at an inexpensive restaurant (usually small ethnic hole in the walls) but we will occasionally splurge on our anniversary or birthdays. The best thing about our efforts is not just the amount of money we have managed to save, but also the confidence we have now from knowing we are doing what’s best financially and knowing we are capable of relying on ourselves when it comes to cooking food!